oklahoma franchise tax return form

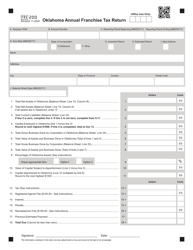

Prepare and file your Oklahoma Annual Franchise Tax Return and provide the businesss FEIN. Estimated IReturn Oklahoma Annual Franchise Tax Return Revised 5-2015 FRX 200 Dollars Dollars Cents Cents 00 00 00 00 00 00 00 00 00 00 00 The information contained in.

Taxamize Accounting Provides Tax Preparation Remedies By Irs Approved Professionals We Specialize In Enlightening Ou Payday Loans Payday No Credit Check Loans

Corporations filing a stand-alone Oklahoma Annual Franchise Tax Return Form 200 or who are not required to file a.

. To make this election file Form 200-F. Corporations not filing Form. All regular corporations and subchapter-S corporations are required to file Form 200 Annual Franchise Tax Return and pay franchise tax.

The franchise excise tax is levied and assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital used in-vested or. Please put your FEIN on your check. Oklahoma Annual Franchise Tax Return State of Oklahoma On average this form takes 62 minutes to complete.

Who to Contact for Assistance For franchise tax assistance call the Oklahoma Tax Commission at. 2021 Form 512-S Oklahoma Small Business Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma. Complete Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax to determine the combined taxable income to report on page 2 Section Two lines 18 25 of.

Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. Franchise Tax Payment Options New Business Information New Business Workshop.

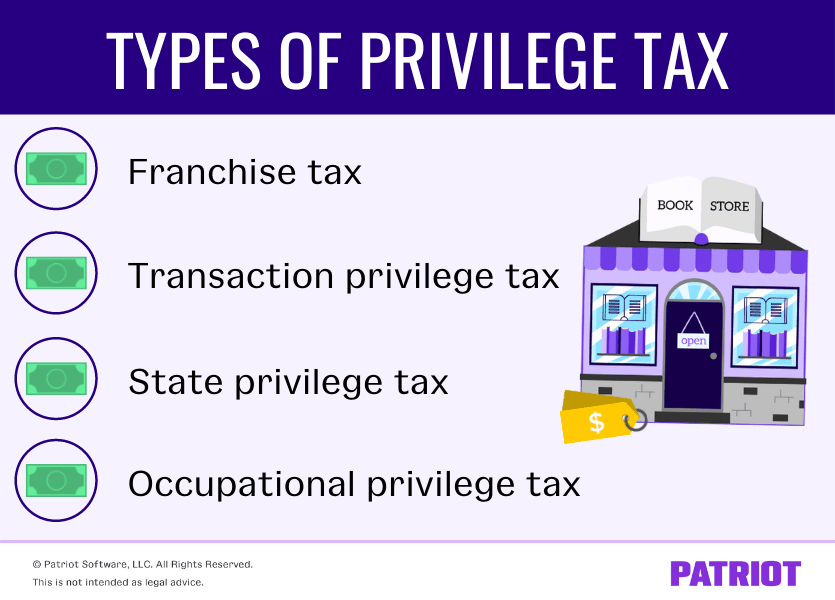

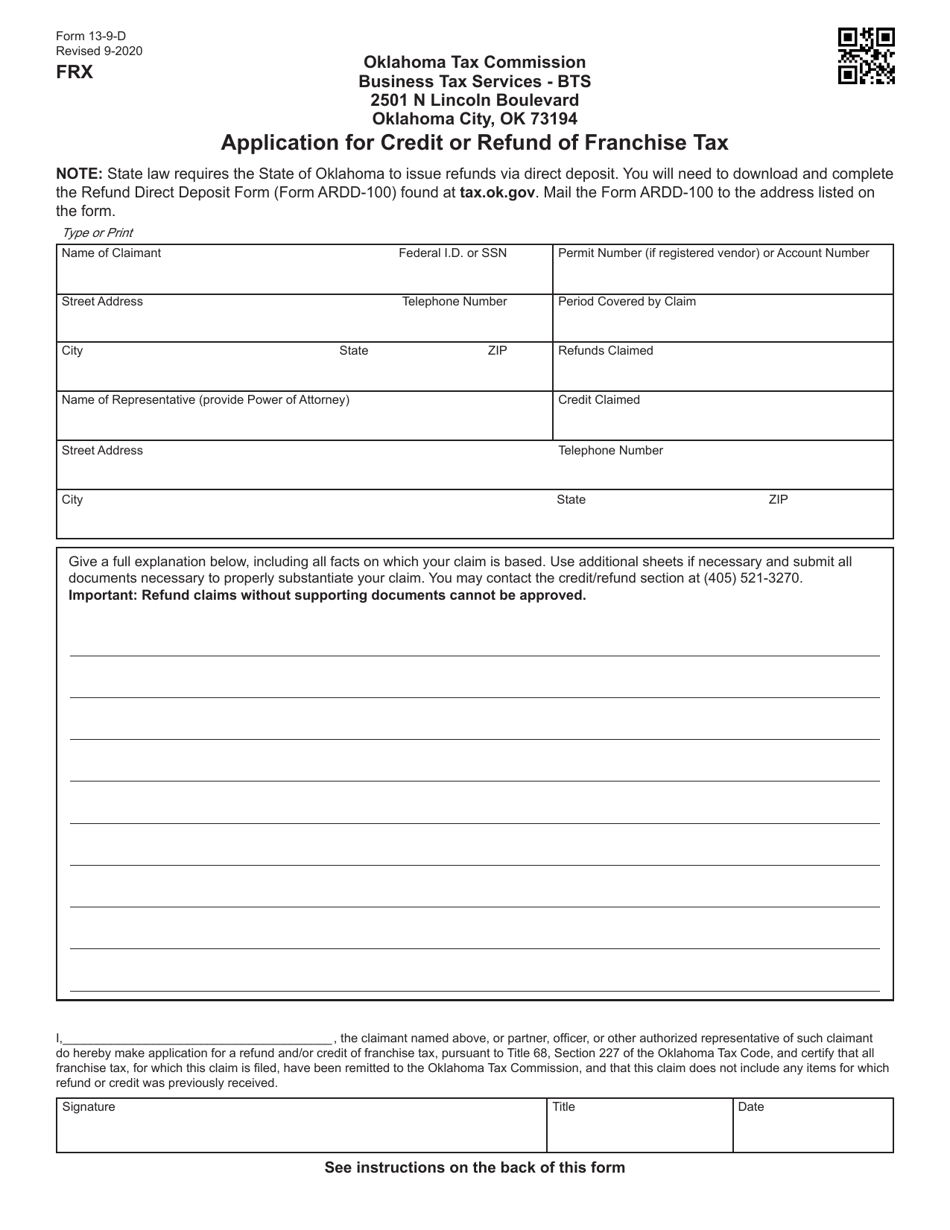

Acquired by the nature of all organizations falling within the purview of the Franchise Tax Code. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Applications for refunds must include copies of your related Oklahoma Income.

Mine the amount of franchise tax due. Form 200-F must be filed no later than July 1. Corporations required to file a franchise tax return may elect to file a combined corporate.

To make this election file Form 200-F. Browse By State Alabama AL Alaska AK Arizona AZ. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200.

Ad Fill Sign Email OK Form 200 More Fillable Forms Register and Subscribe Now. Download Oklahoma Annual Franchise Tax Return 200 Tax Commission Oklahoma form. To make this election file Form 200-F.

Forms - Business Taxes Forms - Income Tax Publications Exemption. Corporations that remitted the maximum. Fill out and file Schedule A which provides the name and contact information for the businesss.

Complete OTC Form 200-F. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. Franchise tax return should.

Oklahoma Tax Commission with each report submitted. Franchise Tax Computation. Corporations that remitted the maximum.

File the annual franchise tax using the same period and due date of their corporate income tax filing year or File the annual franchise tax on the Oklahoma Corporate Income Tax Form 512. When submitting the Franchise Tax Return foreign corporations must pay a 100 registered agensts fee. Complete Sections One and Three on pages.

You may file this form online or download it at wwwtaxokgov. 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma On average this form takes 259 minutes to complete The 2021 Form 512. Not-for-profit corporations are not subject to.

1 120-S must le an Oklahoma income tax return. If you wish to make an election to change your filing frequency or to file using the Oklahoma Corporate Income Tax Form 512 or 512-S complete OTC Form 200-F.

Top Earning Estates For 2019 Estate Planning Attorney Estate Planning Attorney At Law

:max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)

Form 1065 U S Return Of Partnership Income Definition

Irs Installment Agreement Chicago Il 60647 Mm Financial Consulting Inc Chicago Internal Revenue Service Lettering

Oklahoma Tax Commission Oktaxcommission Twitter

Awesome Depreciation Tax Shield In Hire Purchase Is Claimed By In 2022 Hire Purchase Hiring Tax

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Form 13 9 D Download Fillable Pdf Or Fill Online Application For Credit Or Refund Of Franchise Tax Oklahoma Templateroller

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

Trifold Brochure For Two Men And A Truck Trifold Brochure Brochure Moving Company

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

The History Of The Hawks Uniform

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Godzilla Monster S Inc By Roflo Felorez Deviantart Com On Deviantart Godzilla Godzilla Funny Godzilla Comics